Through the KE Live App, they introduces K-Electric quick tax certificate service just as the fiscal year ends and taxpayers prepare to file taxes. With just four clicks, consumers can get their tax certificates, which include withholding tax for net metering users, advance income tax for residents, and sales tax for organizations.

K-Electric quick tax certificate service indicates KE’s commitment to improving customer satisfaction and efficiency while bridging the gap between the company and its customers through innovation and technology.

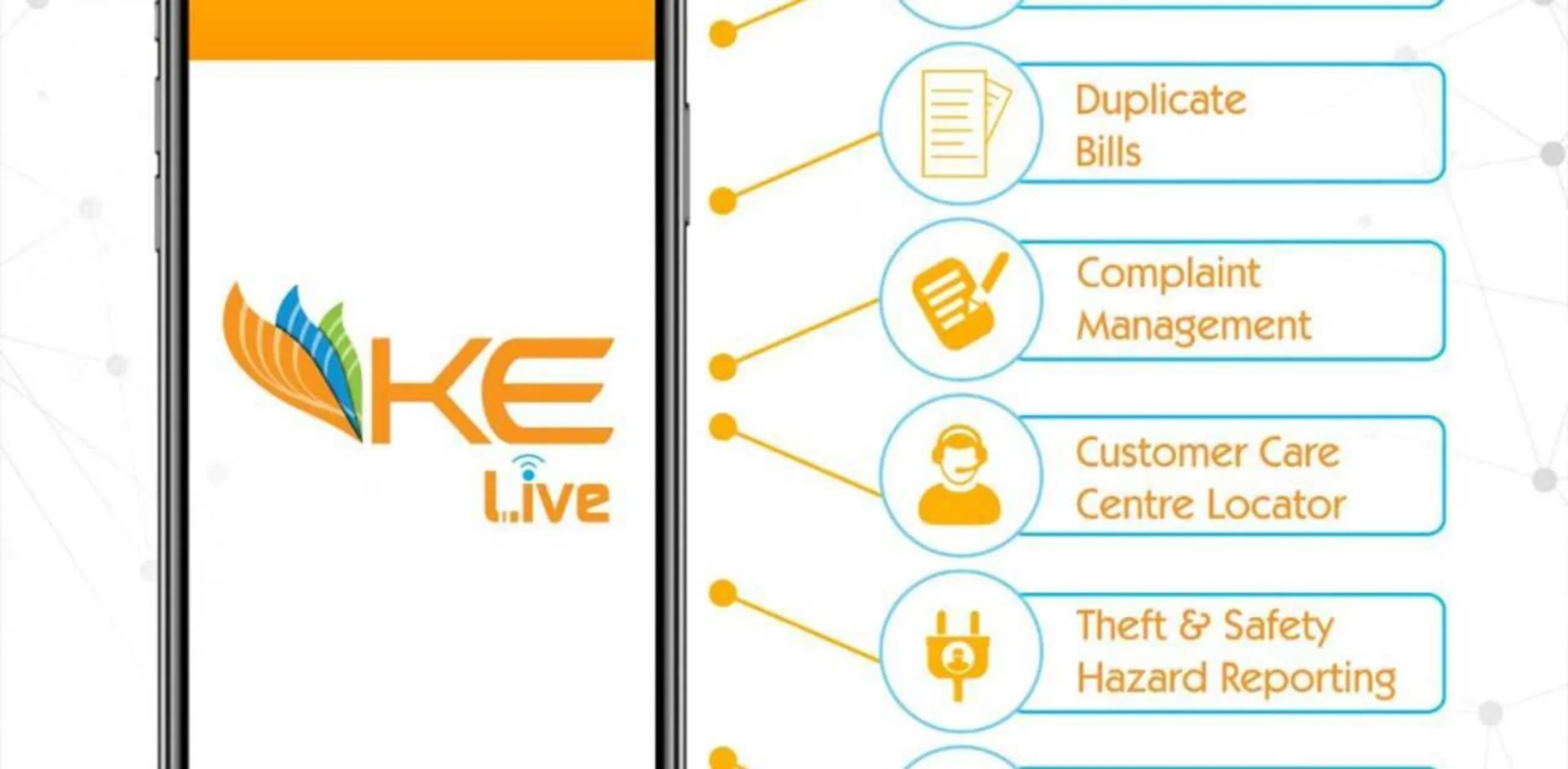

Regarding the new features, a KE spokesperson expressed satisfaction with the app’s service expansion and its ability to provide a digital solution to the need for in-person centers. KE users can now request name changes, apply for new connections, and receive real-time power supply updates from anywhere globally.

PEOPLE ALSO CHECK ABOUT

Residential customers currently face a 7.5% tax on power consumption exceeding PKR 25,000 a month if they do not file taxes comparable to that of commercial and industrial clients. Distribution companies are in charge of obtaining and depositing these taxes, which Observe every regulation that applies.

Active taxpayers on rent and those whose CNIC addresses are matcheable by their KE bill data can apply for exemption from Advance Income Tax using a simple procedure on the KE website if their account details match. The representative highlighted KE’s dedication to a seamless digital experience and encouraged clients to utilize the company’s website and social media platform 24/7 for immediate support on specific inquiries.

PEOPLE ALSO CHECK ABOUT

Karachi and its surrounding areas are powered by K-Electric, Pakistan’s first vertically integrated power utility, which started in 1913 as KESC before privatizing in 2005. The Infrastructure and Growth Capital Fund, National Industries Group, Al-Jomiah Power Limited, and the Government of Pakistan comprise numerous shareholders, whereas KES Power owns the majority share.