CM Punjab Rozgar Scheme 2025 | Easy Loans for Small Businesses & Startups – Government of Punjab

CM Punjab Rozgar Scheme 2025

In 2025, the CM Punjab Rozgar Scheme under the designation of the Asaan Karobar Finance Arrangement has arose as one of the most ambitious initiatives by the Government of Punjab to support young businesspersons and small businesses. The programme offers easy, interest-free or highly subsidised loans, aims to boost service and self-reliance, and is intended to help you launch or expand your business with negligible hassle.

Quick Information Table

| Programme Name | Start Date | End Date | Loan/Assistance Amount | Method of Application |

|---|---|---|---|---|

| Asaan Karobar Finance Scheme (Punjab) | January 16, 2025 | Ongoing (multiple phases) | Loans from PKR 1 million up to PKR 30 million (and cards up to PKR 1 million) | Online via portal + bank branches |

Background of the Punjab Rozgar Programme

The Rozgar Scheme in Punjab first began in 2020 to help unemployed youth presentation their own undertakings. Over time, the scheme evolved into a more accessible format: Asaan Karobar Finance. The 2025 form focuses on broader accessibility, digital requests, and faster loan endorsements.

What is the Asaan Karobar Finance Scheme 2025?

The Asaan Karobar Finance Scheme 2025 is the efficient version of Punjab’s Rozgar initiative. It is intended to provide interest-free (or highly subsidised) loans to small and average enterprises (SMEs), startups and tycoons who wish to begin or expand their businesses. According to official sources: “Small Enterprises with annual sales up to PKR 150 million and Medium Enterprises with annual sales up to PKR 800 million are eligible.” Its aim: financial stability, job-creation, and promoting innovation amongst young Pakistanis.

Main Features of the CM Punjab Rozgar Scheme 2025

Here are the key features that make this scheme beneficial and accessible:

- Interest-free loans (for certain tiers) or highly subsidised loans for business start-ups and expansion.

- Priority for youth, women and differently-abled entrepreneurs – to boost inclusive business growth.

- Partnership with organisations like Punjab Small Industries Corporation (PSIC), and banks like Bank of Punjab for smooth disbursement.

- Transparent online application system to reduce delays and ease processing.

- Flexibility in repayment plans – grace periods, easy instalments.

Loan Amounts and Categories

Here are the broad categories of loan amounts under the scheme:

| Loan Type | Loan Range (PKR) | Interest Type |

|---|---|---|

| Start-ups / youth projects | ~ PKR 1 million to PKR 5 million | 0 % interest (Tier 1) |

| Small Businesses | ~ PKR 6 million to PKR 30 million | 0 % interest or low interest (Tier 2) |

| Card facility (smaller loans) | Up to ~ PKR 1 million via “Karobar Card” route |

Note: These figures are based on latest official information (January-February 2025) and may vary in future phases.

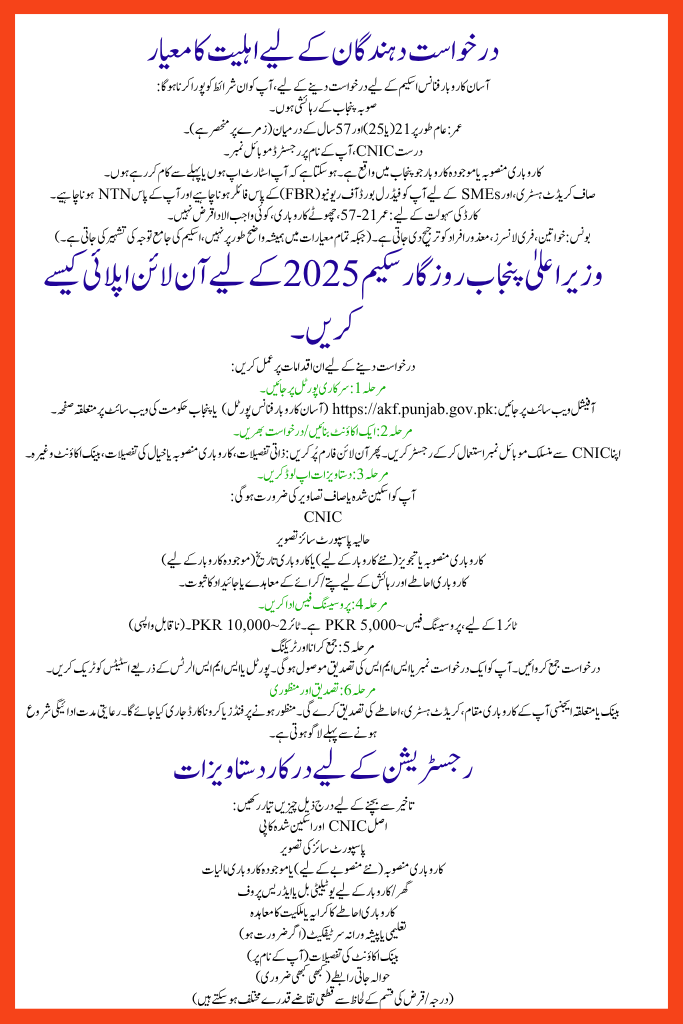

Eligibility Criteria for Applicants

To apply for the Asaan Karobar Finance Scheme, you must meet these conditions:

- Be a resident of Punjab province.

- Age: generally between 21 (or 25) and 57 years (depending on the category).

- Valid CNIC, registered mobile number in your name.

- Business plan or existing business located in Punjab. You may be a start-up or already operating.

- Clean credit history, and for SMEs you must be a filer with the Federal Board of Revenue (FBR) and have NTN.

- For card facility: Age 21-57, small entrepreneur, no overdue loans.

- Bonus: Women, freelancers, disabled persons are given preference. (While not always explicitly in all criteria, scheme’s inclusive focus is publicised.)

How to Apply Online for CM Punjab Rozgar Scheme 2025

Follow these steps to apply:

Step 1: Visit the official portal

Go to the official website: https://akf.punjab.gov.pk (Asaan Karobar Finance portal) or the relevant page on the Punjab government website.

Step 2: Create an account / fill application

Register using your CNIC-linked mobile number. Then fill in the online form: personal details, business plan or idea details, bank account, etc.

Step 3: Upload Documents

You’ll need scanned or clear photos of:

- CNIC

- Recent passport-size photo

- Business plan or proposal (for new business) or business history (for existing business)

- Proof of address / rent agreement or property for business premises and residence.

Step 4: Pay Processing Fee

For Tier 1, the processing fee is ~ PKR 5,000; Tier 2 ~ PKR 10,000. (Non-refundable)

Step 5: Submission & Tracking

Submit the application. You will receive an application number or SMS confirmation. Track status via the portal or SMS alerts.

Step 6: Verification & Approval

The bank or relevant agency will verify your business location, credit history, premises. If approved, funds or the Karobar Card will be issued. Grace period applies before repayment starts.

Documents Required for Registration

Have ready the following to avoid delays:

- Original CNIC and a scanned copy

- Passport-size photograph

- Business plan (for new venture) or existing business financials

- Utility bill or address proof for home/business

- Rent or ownership agreement of business premises

- Educational or vocational certificate (if required)

- Bank account details (in your name)

- Reference contacts (sometimes required)

(Exact requirements may vary slightly by tier/loan type)

How the Asaan Karobar Card Works

Apart from loan financing, the scheme provides the Asaan Karobar Card (for smaller entrepreneurs) which acts as a digital business credit card:

- Maximum limit ~ PKR 1 million.

- Grace period ~ 3 months before repayments start.

- First 50 % of limit usable in first 6 months; remaining released after demonstration of proper use.

- Cash withdrawal allowed up to 25 % of limit; remaining must be used for business transactions (vendor payments, utility bills, government fees).

- Funds must be used for business-related activities; personal consumption is restricted.

Impact of the Scheme on Employment

Since its launch, this programme has had a visible impact: In just a 3-month period, more than 107,000 people received loans worth PKR 61 billion under the programme. Over 57,000 new businesses started in that period alone. Women entrepreneurs received loans worth PKR 3.42 billion.

This shows how the scheme helps create jobs, promote entrepreneurship, and reduce youth unemployment in Punjab.

Current Status and Future Expansion

- As of mid-2025 the scheme is active and ongoing.

- The government plans to expand limits, ease further verifications, include freelancers and online workers in future phases.

- Watch for updates on digital credit-scoring and simplified approval systems.

Final Thought

The CM Punjab Rozgar Scheme 2025 via the Asaan Karobar Finance and Card is a powerful opportunity for hardworking Pakistanis who want to create jobs, not just seek them. With interest-free or low-interest loans, inclusive eligibility, and streamlined online application, this is one of the best times to apply. If you have an idea, a business plan, or wish to expand your enterprise—this scheme can help turn your dream into reality.

FAQs about CM Punjab Rozgar Scheme

When was the CM Punjab Rozgar/Asaan Karobar Scheme 2025 launched?

It was launched in early 2025 (January) by the Punjab Government.

How much loan can I get?

Depending on category: Tier 1 ~ PKR 1 million to PKR 5 million; Tier 2 ~ PKR 6 million to PKR 30 million. Smaller “Karobar Card” up to PKR 1 million.

Is the loan interest-free?

Yes – for many categories (Tier 1 & Tier 2) interest rate is 0 % for specified period.

Who can apply?

Residents of Punjab, age 21-57, valid CNIC, business plan, tax-filer status (for SMEs), clean credit history, business located in Punjab.

Where can I apply?

On the official portal of the scheme (akf.punjab.gov.pk) or via Punjab Government website section for entrepreneurship/SMEs.