Jubilee Insurance has been a trusted name in Pakistan for years. Jubilee Insurance offers a range of insurance plans that are tailored as per the required needs to protect you and your business. Each option is tailored to fit your needs.

Imagine having the confidence that both your family and your assets are protected. With Jubilee Insurance’s numerous plans, you can enjoy peace of mind. So, start your journey to a worry-free future today. Read on to explore Jubilee Insurance types and find the right plan for you.

Why makes Jubilee Insurance unique, & why choose it in 2025?

Jubilee Insurance is an excellent choice for both families and businesses, providing a variety of benefits that establish it as a reliable and trustworthy option.

With a wide array of coverage options designed for both individuals and businesses, Jubilee Insurance guarantees that you are always safeguarded. Their strong reputation for dependability has made them a preferred insurance provider for many.

What sets Jubilee apart is its offering of unique products like Takaful and specialized coverage for different industries, providing customers with innovative solutions tailored to their needs.

Whether you are an individual or a business, Jubilee Insurance assists you in finding the most suitable insurance plan for your specific circumstances. The services of Jubilee Insurance are available across Pakistan, making it easier to access the consultation whenever the customer wants.

Jubilee Insurance: A Comprehensive Guide of Jubilee General and Jubilee Life Insurance

Jubilee Insurance provides a diverse range of coverage options designed to meet both short-term and long-term needs. Jubilee Insurance has two main divisions, Jubilee General Insurance, and Jubilee Life Insurance, that offer customized plans addressing different life aspects. Jubilee General emphasizes personal and business protection, while Jubilee Life is dedicated to securing your financial future.

PEOPLE ALSO CHECK ABOUT

Divisions of Jubilee Insurance:

Jubilee Insurance consists of two primary divisions: Jubilee General Insurance and Jubilee Life Insurance.

Jubilee General Insurance provides various coverage options for both businesses and individuals, including motor, self-care, health, homecare, travel, and liability insurance. The main goal of Jubilee Insurance is to offer protection against unexpected risks.

On the other hand, Jubilee Life Insurance focuses on life insurance products, including individual insurance plans, family takaful insurance, microinsurance, and corporate insurance, aimed at ensuring long-term financial security for individuals, families, and businesses.

1. Jubilee General Insurance:

Jubilee General Insurance provides a variety of coverage options, such as health, property, motor, and business insurance. Whether you’re safeguarding your home from unexpected damage or ensuring your car is protected against accidents, Jubilee General offers thorough solutions for both personal and business requirements. Adaptable plans of Jubilee General Insurance are crafted to offer you peace of mind, regardless of what challenges life may present.

2. Jubilee Life Insurance:

Jubilee Life Insurance is dedicated to offering long-term financial protection for you and your loved ones. With a range of individual life policies and group plans, they provide coverage that encompasses life, health, and savings options, helping you secure your future. It’s an ideal choice for those seeking financial stability and peace of mind for themselves and their families.

What insurance can you receive from Jubilee General Insurance?

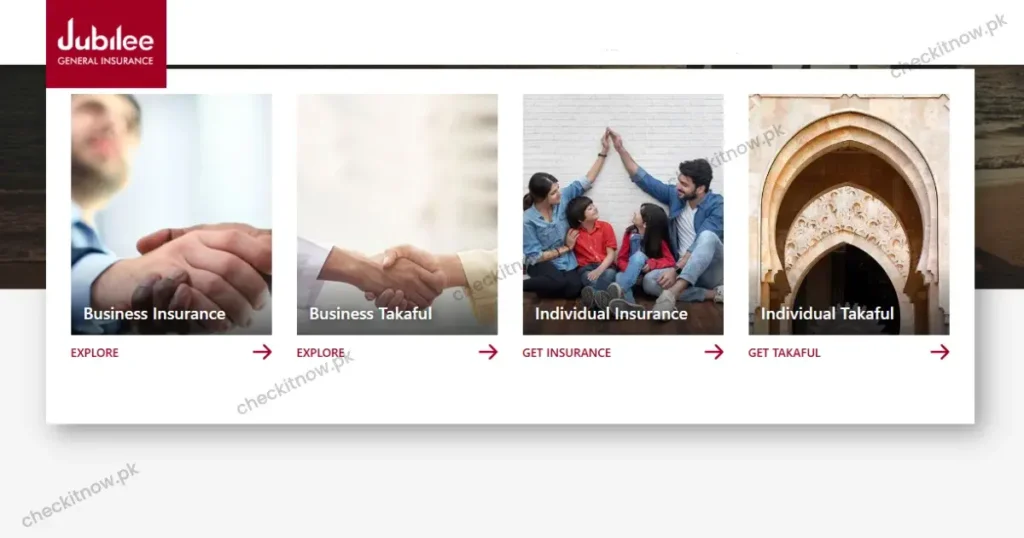

Jubilee General Insurance provides numerous types of insurance for both businesses and individuals, ensuring comprehensive protection for various needs.

With the innovative options of Jubilee General Insurance like Takaful and specialized products for individual and corporate sectors, it ensures comprehensive protection across multiple sectors, providing a tailored solution for all.

(a). Insurance Product for Individuals:

Jubilee General Insurance offers a wide range of individual insurance options, including Jubilee health insurance, Jubilee travel insurance, Jubilee home insurance, and Jubilee motor insurance. Explore more to read more about each product.

● Jubilee Travel Insurance:

Jubilee Travel Insurance offers Jubilee Travel Insurance to individuals comprehensive coverage of their entire trip stay, including medical emergencies, evacuation, travel inconvenience, accidental death, and many other hazards.

● Jubilee Health Insurance:

With the rising inflation, the need for family medical care and hospitalization is growing rapidly. Jubilee health insurance provides coverage to more than one family member, so your loved one stays covered when the need arises.

● Jubilee Home Insurance:

Jubilee home insurance plans were designed to provide extensive coverage for one of the most valuable assets: the home. With customizable options, one can protect their home from unexpected risks and ensure its security for years to come.

● Jubilee Selfcare Insurance:

Jubilee Selfcare Insurance by Jubilee Insurance Company offers protection against temporary or permanent disabilities, unfortunate accidental death, or financial losses and covers any sort of medical expense during such incidents.

● Jubilee Motor Insurance:

Different plans under Jubilee Motor Insurance offer financial protection for their motor vehicles, protecting against accidents, theft, damage, and third-party liability.

PEOPLE ALSO CHECK ABOUT

(b). Jubilee Insurance for Businesses:

Jubilee General Insurance provides customized plans for businesses, including coverage for property, liability, and employee welfare, to protect assets and maintain operational continuity.

● Jubilee Property Insurance:

Safeguard your business and assets from unforeseen losses by securing coverage for fire, related risks, and business interruptions provided by Jubilee Property Insurance.

● Jubilee Engineering Insurance:

With the coverage of Jubilee Engineering Insurance, anyone can safeguard their business and assets from unforeseen losses by securing coverage for fire, related risks, and business interruptions

● Jubilee Marine Insurance:

Protect your marine assets with comprehensive coverage of Jubilee Marine Insurance for cargo, hull, port packages, and inland transit, guaranteeing full security throughout the journey.

● Jubilee Business Fleet Insurance:

Tailored protection is provided by Jubilee business fleet insurance for companies with a fleet of vehicles, providing coverage for vehicle damage and third-party liability.

● Oil and Energy Insurance:

Safeguard your oil and energy companies from high-risk offshore and onshore projects, assisting in risk management and ensuring operational continuity with oil and energy insurance.

● Jubilee Health Insurance:

Jubilee Health Insurance offers medical coverage for individuals and groups, encompassing hospital stays and ongoing care to address a variety of health needs.

● Jubilee crop and livestock insurance:

Jubilee crop and livestock insurance protects farmers and livestock owners against natural disasters, diseases, and accidents, helping to stabilize agricultural businesses and encourage growth.

● Jubilee Liability Insurance:

Jubilee Liability Insurance provides legal protection for businesses and professionals, addressing liabilities related to public, commercial, professional, medical malpractice, and employer responsibilities.

● Jubilee Bonds Insurance:

Jubilee Bonds Insurance helps you ensure your financial security in contracts by providing coverage for bid, performance, supply, and mobilization advance bonds, giving businesses peace of mind.

● Jubilee Insurance Financial Lines:

Specialized coverage is provided by Jubilee General Insurance’s financial lines for risks in the financial sector, such as fraud, crime, director liability, safe cash in transit, and guarding businesses against financial losses.

● Jubilee Miscellaneous Insurance:

Jubilee Miscellaneous Insurance covers employee dishonesty, cash in transit, plate glass, group travel, and various other unforeseen business risks.

● Jubilee Specialized Insurance:

Custom insurance solutions are designed under Jubilee specialized insurance for specific requirements, such as residual value protection, event cancellation coverage, legal liability for stevedores, and aviation insurance.

PEOPLE ALSO CHECK ABOUT

Insurance Products offered by Jubilee Life Insurance:

Jubilee Life Insurance provides several insurance plans designed to meet your specific needs. Whether you’re looking to secure your future, safeguard your family, or prepare for unforeseen circumstances, Jubilee Life Insurance ensures you have the coverage you need. With options available for individuals and businesses alike, their plans offer reassurance that you’re ready for whatever life may throw at you.

(a). Individual Insurance Plans by Jubilee Life Insurance:

The individual plans of Jubilee Life Insurance are available under Jubilee Life, offering comprehensive coverage and flexibility to cater to your specific needs.

● Child Education Insurance:

Jubilee Life Child Education Insurance Plans aim to secure your child’s future by providing financial assistance for their education. These plans help guarantee that your child can access quality education, no matter what unexpected events may arise, all while keeping costs flexible.

● Marriage Insurance:

Under Individual Insurance Plans, Jubilee Life’s Marriage Plans offer a clever approach to saving for your child’s wedding. These plans assist in gradually building up funds, ensuring you are financially ready for the big day without the pressure of scrambling for savings at the last minute.

● Health Insurance:

Jubilee Life’s Health Plans, which fall under individual insurance, offer extensive coverage for medical expenses. From hospitalization to regular health checkups, these plans guarantee that you get the necessary care without the stress of overwhelming medical bills.

● Retirement Insurance:

Jubilee Life’s Retirement Plans, which fall under individual insurance, assist you in preparing for a worry-free life after retirement. By saving money throughout your career, you can benefit from a reliable income and financial stability once you retire.

● Wealth accumulation insurance:

Jubilee Life’s Wealth Accumulation Plans are individual insurance products that blend life protection with investment options. These plans aim to help you grow your wealth while ensuring your family’s future is protected with life insurance coverage.

● Savings and Protection Insurance:

Jubilee Life’s Savings & Protection Plans in individual insurance provide two key advantages: saving for your future and offering life coverage. These plans guarantee that you and your loved ones are financially secure in case of unforeseen events, while also helping you grow your savings over time.

● Traditional Insurance:

Jubilee Life’s plans in individual insurance provide simple life coverage without any investment elements. These plans aim to offer financial security to individuals and their families, giving them peace of mind in the face of life’s uncertainties.

PEOPLE ALSO CHECK ABOUT

(b). Bancassurance plans by Jubilee Life Insurance:

Jubilee Life Insurance partners with multiple banks to provide customized insurance solutions to those who require them. Partnered banks include:

- Habib Bank Limited

- MCB Bank Limited

- United Bank Limited

- Bank Alfalah Limited

- Samba Bank Limited

- Habib Metro Bank

- Askari Bank

- Bank of Azad Jammu & Kashmir

- Allied Bank Limited

- National Bank of Pakistan (NBP)

These bank-based plans are tailored to cater to the unique financial needs of their customers, offering both life and health insurance solutions.

(c). Microinsurance by Jubilee Life Insurance

Jubilee Life’s microinsurance plans aim to provide affordable coverage for individuals from low-income backgrounds. These plans offer essential life, health, and accident insurance, ensuring that even the most vulnerable populations can access financial protection.

(d). Corporate Insurance by Jubilee Life Insurance

Jubilee Life’s Corporate Health Insurance allows businesses to offer their employees extensive healthcare coverage. This plan guarantees that employees can access medical care, which helps decrease absenteeism and fosters a healthier, more productive workforce.

(e). Family Takaful Insurance

Jubilee Life’s Family Takaful offers a Shariah-compliant option to traditional life insurance. It ensures financial protection for families through a system of cooperative risk-sharing. This plan is designed to safeguard the future of your loved ones while following Islamic principles.

How to know which Jubilee insurance is best suited for you?

In case of any issue or confusion, feel free to follow the given points to easily select and choose the best insurance type and plan.

- Access your needs: When using the insurance, first assess your needs. If you are an individual, choose the individual type of insurance; in the case of a business, select the insurance type by evaluating your industry-specific risks.

- Gain Information: After that, learn about the different insurance plans of the selected insurance to better understand the most relevant one.

- Compare Jubilee Insurance Plans: Once the insurance plan is selected, compare it with your budget to determine affordability.

- Key features of plans: Check for the specific terms, exclusions, and benefits of different insurance plans.

- Consult with an expert: If you encounter any confusion or issue, consult with an insurance expert for suggestions or advice.

PEOPLE ALSO CHECK ABOUT

Frequently Asked Questions

How does Insurance give you peace of mind?

Insurance provides policyholders with the necessary financial protection against unforeseen events confidently. So, whether it’s safeguarding health, property, or your life, insurance provides peace of mind by reducing stress and covering potential losses.

How can I insure myself for Jubilee health insurance?

Getting Jubilee health insurance is simple. You need to identify your healthcare needs and budget first, then compare different health plans and choose one that is suitable for your needs. Once decided, apply for the policy by visiting the company or via the online method. Visit website

Conclusion

Jubilee Insurance has always been a beacon of trust and trustworthiness in the insurance market. Jubilee Insurance is a home of diverse creative products for both businesses and individuals. Each of the insurance plans by Jubilee Insurance offers excellence and customer satisfaction. For peace of mind for yourself and your family, or business continuity or financial security, Jubilee Insurance has solutions tailored to meet your particular needs.