Many people in Pakistan experience sudden blockage of their SIM and device; wondering why? Well, devices or SIMs that are not registered with the PTA get blocked after a certain period in Pakistan. So, if you have recently returned from an abroad trip with a new smartphone, then registering it with PTA is essential to avoid sudden surprises.

To make the process easier, our PTA Tax Calculator helps you instantly check the exact tax amount you need to pay based on your mobile model. Registering your device doesn’t only ensure seamless network but also helps in strengthening the tax system of Pakistan. Check out our PTA tax list for different models and use our calculator to find out how much PTA tax you need to pay.

PEOPLE ALSO CHECK ABOUT

PTA Tax Calculator – PTA Mobile Tax Check 2025:

Whether you’ve purchased a new smartphone from abroad or want to see PTA approved check registration details of your mobile phone, you can now do it hassle-free. Instead of finding information using complicated methods, there’s now a simpler way to check the PTA mobile tax on your device. With just a few clicks, you can easily find out the exact PTA tax details without making the whole process quick and stress-free for everyone in Pakistan.

Simply enter your mobile model name in the given box below and find details of the PTA tax on your mobile.

PTA Tax Calculator

| iPhone Model | Price in PKR | Price in USD | PTA Tax (CNIC) | PTA Tax (Passport) |

|---|---|---|---|---|

| ${result} | ${data.pricePKR} | ${data.priceUSD} | ${data.taxCNIC} | ${data.taxPassport} |

PEOPLE ALSO CHECK ABOUT

What is the IMEI Number & How to Check IMEI For PTA Mobile Tax

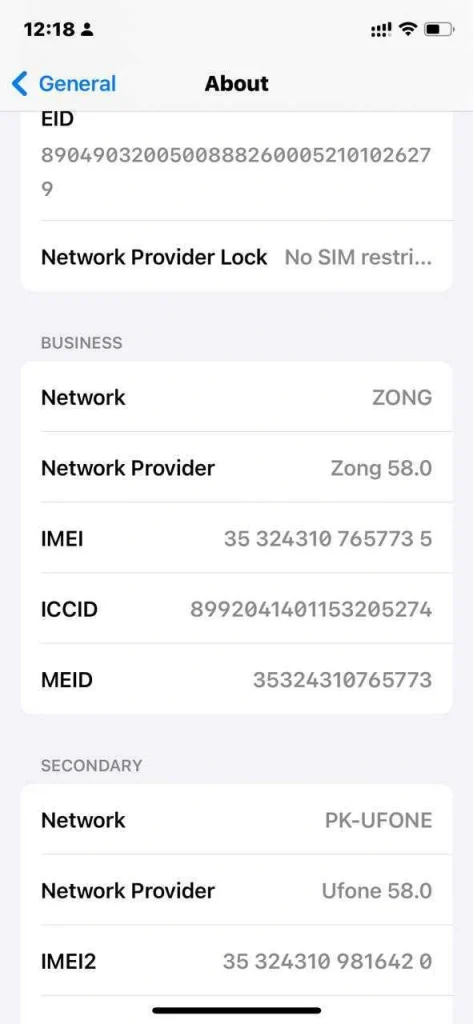

IMEI stands for International Mobile Equipment Identity. IMEI, consisting of 15 digits, is a unique number that is assigned to each device. Users with a single SIM card will have one IMEI, and users with 2 or 3 SIM cards will have 2 or 3 IMEI numbers. IMEI number is located in your mobile’s settings, although both iPhone and Android users will experience different processes of checking IMEI numbers from their settings app.

Check PTA Mobile Tax by PTA IMEI Check Online Method

Each registered mobile user in Pakistan is assigned a unique IMEI number. This number is used for the verification process of your mobile phone. You can retain your IMEI by using numerous ways.

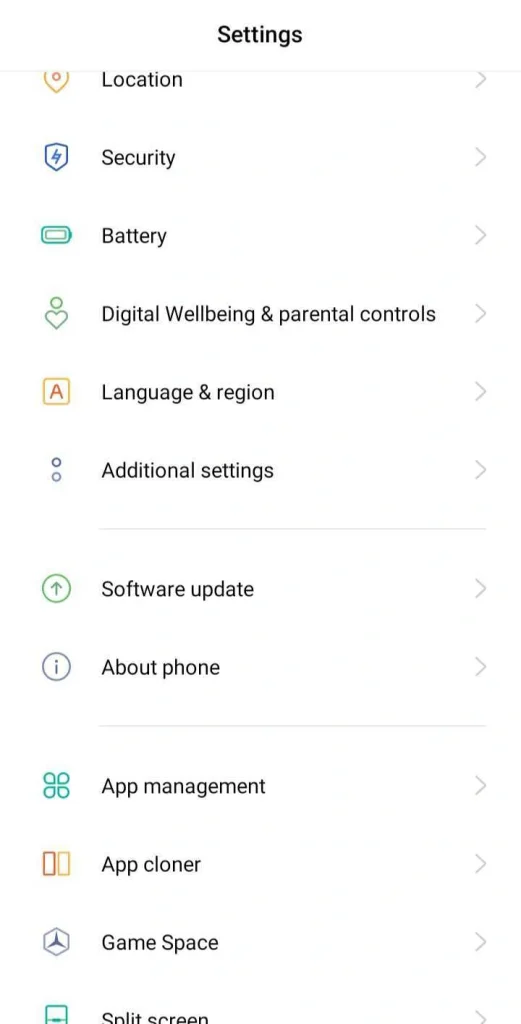

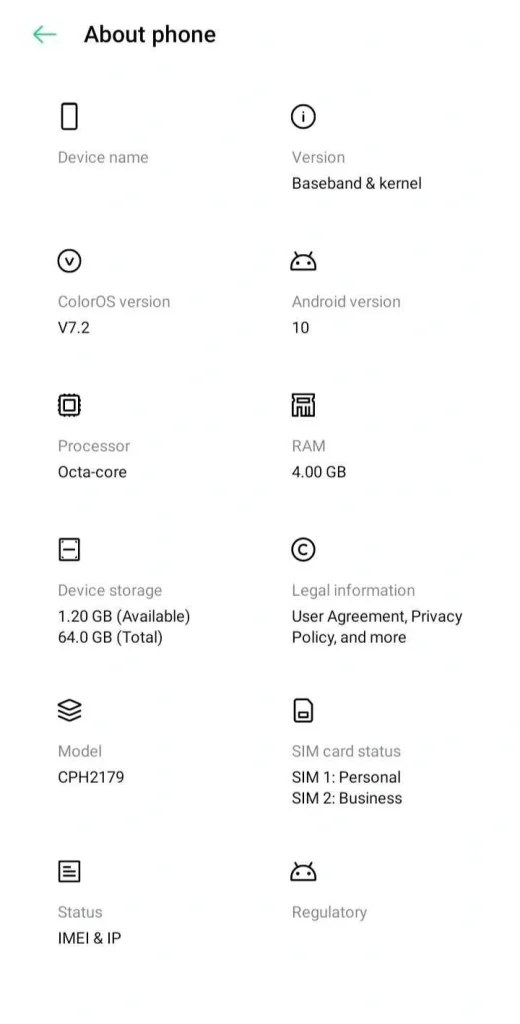

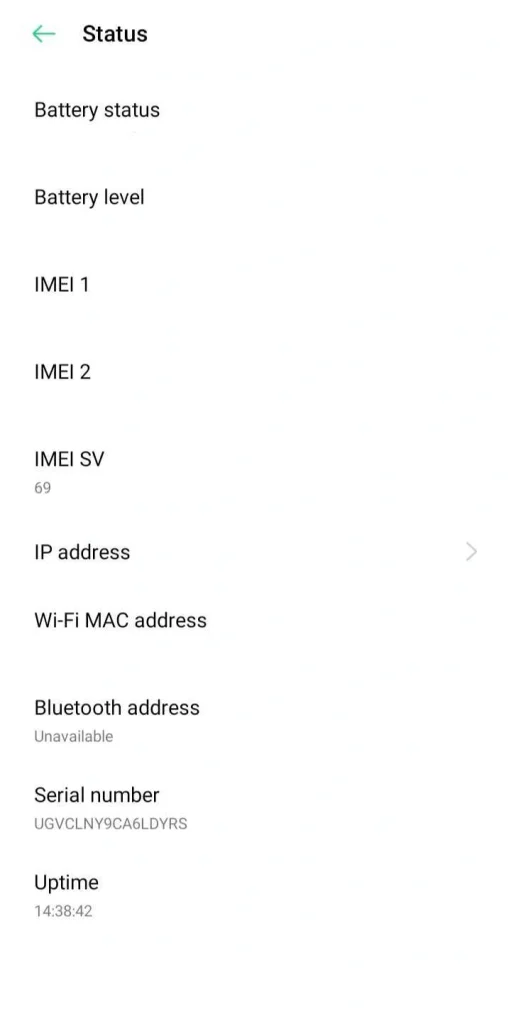

PTA IMEI Check Online - For Android Users:

Step 1: Locate your mobile phone settings.

Step 2: hit on the “About phone” option.

Step 3: then click on the “IMEI & IP” option.

Step 4: Your SIM IMEI number will be showcased on your device.

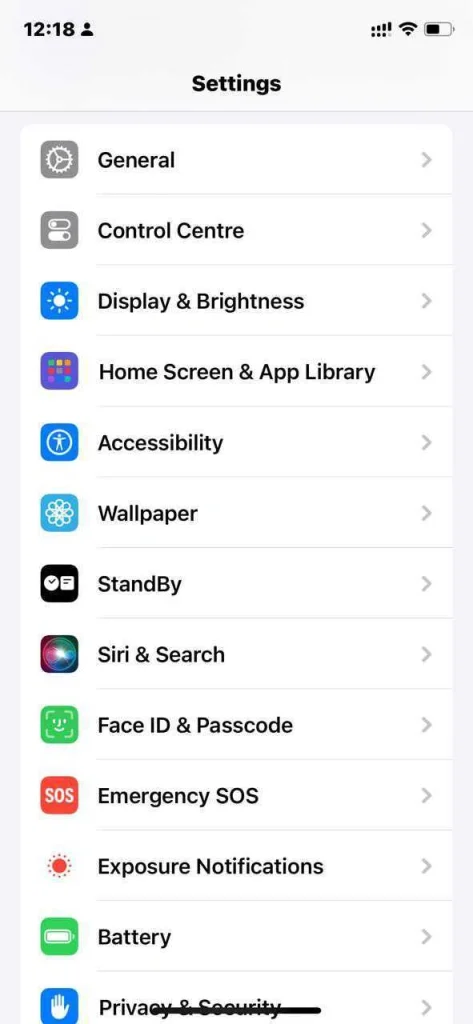

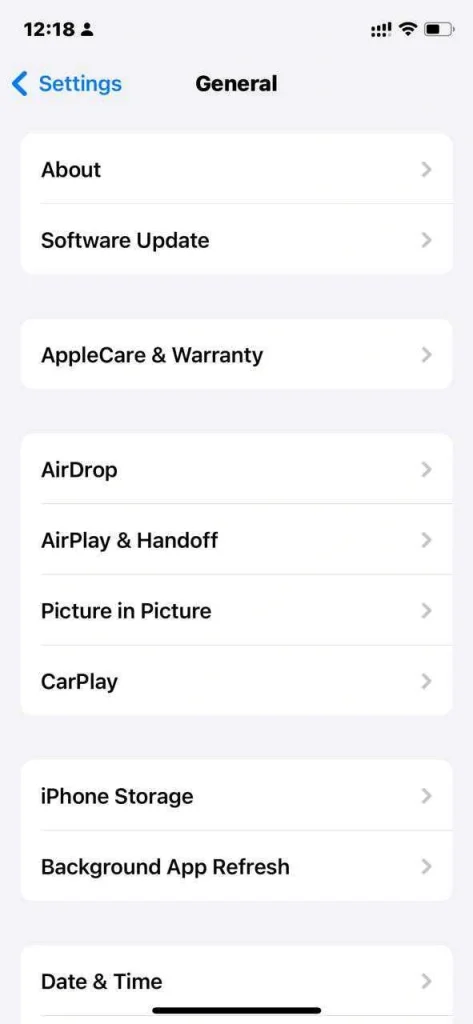

PTA IMEI Check Online - For iPhone Users:

Step 1: In your iPhone, go to settings.

Step 2: Then click the “general” option.

Step 3: After that, hit the “about” option.

Step 4: Scroll down in the information of your device and find your IMEI number.

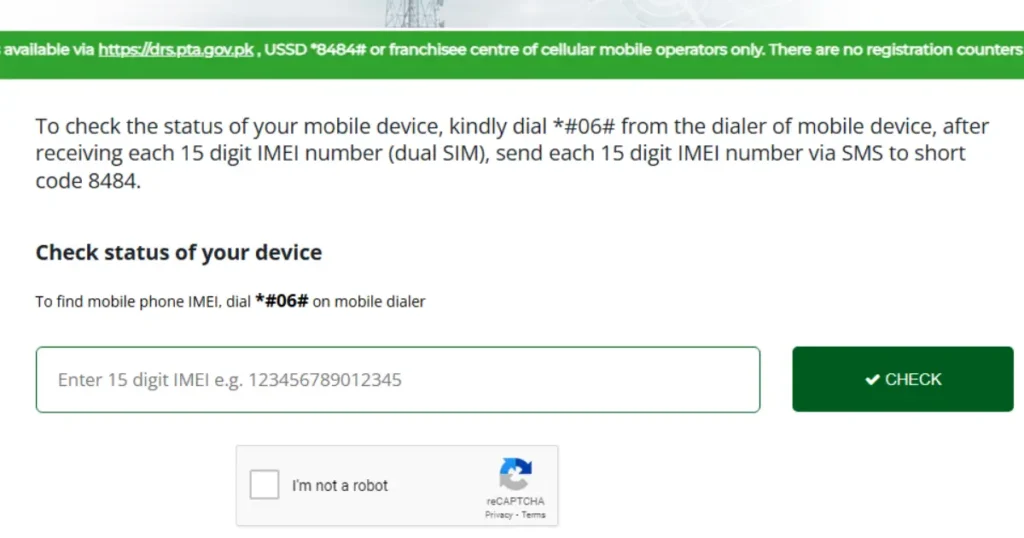

Method 1: Check PTA Mobile Tax Online By DIRBS Website

Accessing the DIRBS website will easily verify your PTA tax status. In order to quickly check your device’s registration and tax status, simply enter your device’s IMEI number, which forms the rest of the result that guarantees you can use your phone uninterrupted in Pakistan.

Step 1: Visit the DIRBS website.

Step 2: Locate the “device verification system” section.

Step 3: Enter your IMEI number in the given area.

Step 4: Lastly, hit the “Check” button.

Step 5: Information about your smartphone will be showcased on the device’s screen.

Method 2: How to Check PTA Mobile Tax Check by SMS?

Checking your PTA mobile tax is very easy; send your IMEI number using the code given in the procedure to receive tax details and check PTA registration on your device.

Step 1: Start by composing a new message in your messaging app.

Step 2: In the message, enter your 15-digit IMEI number.

Step 3: Send this to the code 8484.

Step 4: Wait for the response to be received from PTA.

PEOPLE ALSO CHECK ABOUT

PTA Approved Check & Tax Calculator

If you face any issues with the given method, then sit at ease, as you can manually check your PTA mobile tax within a minute. As we know, PTA is based on how much your mobile phone is worth. So, to figure out the PTA tax on your mobile phone in Pakistan, use the following formula:

Formula of PTA Tax Calculator = (Price of Phone * Tax Rate) + (Customs Duty * (1 + Sales Tax Rate))

To calculate the amount, you will be required to have customs duty and tax information in hand. Read on the given tables to check for the customs duty taxes.

Calculate PTA Tax on Mobile Phones - Formula:

|

Mobile number having value (US dollars) |

Registration on CNIC (Fixed rate) |

Registration on passport (Fixed rate) |

|

Upto 30 |

Rs. 550 |

Rs. 430 |

|

Above 30 and up to 100 |

Rs. 4323 |

Rs. 3200 |

|

Above 100 and up to 200 |

Rs. 11561 |

Rs. 9580 |

|

Above 200 and up to 350 |

Rs. 14661+ 17% Sales Tax Ad Valorem |

Rs. 12,200 + 17% Sales Tax Ad Valorem |

|

Above 350 and up to 500 |

Rs. 23420 + 17% Sales Tax Ad Valorem |

Rs. 17,800 + 17% Sales Tax Ad Valorem |

|

Above 500 |

Rs. 37007 + 17% Sales Tax Ad Valorem |

Rs. 27,600 + 17% Sales Tax Ad Valorem |

PTA Tax List for all iPhones:

|

Price in PKR |

Price in US Dollars |

PTA Tax (CNIC registration) |

PTA Tax (Passport registration) |

|

|

iphone 6 pta tax |

Rs. 46,899 |

$ 167 |

Rs. 40,000 |

Rs. 35,529 |

|

iphone 7 pta tax |

Rs 73,899 |

$ 264 |

Rs. 45,766 |

Rs. 40,635 |

|

iphone 7 plus pta tax

|

Rs 79,999 |

$ 286 |

Rs. 65,280 |

Rs. 64,036 |

|

iphone 8 pta tax

|

Rs 108,610 |

$ 388 |

Rs. 67,784 |

Rs. 56,651 |

|

iphone 8 plus pta tax

|

Rs 122,499 |

$ 438 |

Rs. 70,016 |

Rs. 58,651 |

|

iphone x pta tax |

142,000 |

$ 511 |

Rs. 61,147 |

Rs. 51,740 |

|

iphone xs pta tax

|

Rs 141,999 |

$ 508 |

Rs. 109,266 |

Rs. 87,833 |

|

iphone xs max pta tax |

Rs 167,499 |

$ 599 |

Rs. 112,871 |

Rs. 91,110 |

|

iphone 11 pta tax |

Rs 144,899 |

$ 518 |

Rs. 86,689 |

Rs. 67,308 |

|

iphone 11 pro pta tax |

Rs 207,799 |

$ 744 |

Rs. 115,148 |

Rs. 93,180 |

|

iphone 11 pro max pta tax |

Rs 226,599 |

$ 811 |

Rs. 119,196 |

Rs. 96,860 |

|

iphone 12 pta tax |

Rs 175,599 |

$ 628 |

Rs. 107,432 |

Rs. 86,165 |

|

iphone 12 pro pta tax |

Rs 220,899 |

$ 791 |

Rs. 125,205 |

Rs. 103,335 |

|

iphone 12 pro max pta tax |

Rs 236,999 |

$ 848 |

Rs. 130,708 |

Rs. 107,325 |

|

iphone 13 pta tax |

Rs 273,899 |

$ 980 |

Rs. 118,380 |

Rs.90,880 |

|

iPhone 13 Pro max |

452,000 |

1628 |

Rs. 113,847 |

Rs. 104,440 |

|

Rs 384,999 |

$ 1378 |

Rs. 130,708 |

Rs. 107,325 |

|

|

iphone 14 pro pta tax |

Rs 518,999 |

$ 1858 |

Rs. 147,153 |

Rs. 122,275 |

|

iPhone 14 Pro max pta tax |

Rs. 560,000 |

$ 2,018 |

Rs. 132,207 |

Rs. 122,800 |

|

iphone 15 pta tax |

Rs. 344,999 |

$ 1235 |

Rs. 130,708 |

Rs. 107,325 |

|

iphone 15 pro pta tax |

Rs. 419,999 |

$ 1504 |

Rs. 161,480 |

Rs. 135,300 |

|

iPhone 15 Pro max pta tax in Pakistan |

Rs. 671,000 |

$ 2,418 |

Rs. 151,077 |

Rs. 141,670 |

|

Rs. 380,499 |

$ 799 |

PKR 130,708 |

PKR 107,325 |

|

|

iPhone 16 Pro max |

Rs. 554,499 |

$ 1696 |

PKR 176,000 |

PKR 148,500 |

|

Rs. 472,499 |

$ 1640.62 |

PKR 161,480 |

PKR 135,300 |

|

|

iPhone 16 Plus |

Rs. 419,499 |

$ 1283 |

PKR 137,033 |

PKR 113,075 |

|

iPhone 16 Pro max |

Rs. 554,499 |

$ 1696 |

PKR 176,000 |

PKR 148,500 |

PTA Mobile Tax on Google Pixel Models:

Since the PTA requires all imported mobile phones to be registered and taxed before use on local networks. Check out the listed PTA tax on all Google Pixel mobile phones so you can clear your PTA mobile tax today and enjoy the features of your mobile to the fullest.

|

Google Pixel model |

PTA Tax (on Passport) |

PTA Tax (on CNIC) |

|

Google Pixel Fold PTA Tax |

Rs. 112,111 |

Rs. 125,698 |

|

Google Pixel 9 Pro PTA Tax |

Rs. PKR 112,111 |

Rs. 129,250 |

|

Google Pixel 9 PTA Tax |

Rs. 80,500 |

Rs. 101,200 |

|

Pixel 8 Pro PTA Tax |

Rs. 106,000 |

Rs. 129,250 |

|

Pixel 8 PTA Tax |

Rs. 80,500 |

Rs. 101,200 |

|

Pixel 8a PTA Tax |

Rs. 33,800 |

Rs. 46,000 |

|

Pixel 7 Pro PTA Tax |

Rs. 83,000 |

Rs. 103,950 |

|

Pixel 7 PTA Tax |

Rs. 68,162 |

Rs. 87,628 |

|

Pixel 7a PTA Tax |

Rs. 44,200 |

Rs. 54,120 |

|

Pixel 6 Pro PTA Tax |

Rs. 81,164 |

Rs. 101,930 |

|

Pixel 6 PTA Tax |

Rs. 81,164 |

Rs. 101,930 |

|

Pixel 6a PTA Tax |

Rs. 29,180 |

Rs. 33,165 |

|

Pixel 5 PTA Tax |

Rs. 77,644 |

Rs. 98,058 |

|

Pixel 5a 5G PTA Tax |

Rs. 36,800 |

Rs. 43,205 |

|

Pixel 4a 5G PTA Tax |

Rs. 3150 |

Rs. 3850 |

PTA Mobile Tax on OnePlus Smartphones:

Owning a OnePlus phone and unsure why your mobile features and SIM aren’t working? The reason is the PTA mobile tax. You can use the PTA tax checker tool to check and pay your PTA mobile tax in the easiest way possible. Find the model of your mobile phone and get it cleared today.

|

OnePlus model |

PTA Tax Minimum to Maximum |

|

OnePlus 2 |

Rs. 4,510 – Rs. 5,984 |

|

OnePlus 3 and 3T |

Rs. 33,853 – Rs. 52,000 |

|

OnePlus 5 and 5T |

Rs. 12,436 – Rs. 14,798 |

|

OnePlus 6, 6T, and 6T Mclaren |

Rs. 17,485 – Rs. 23,658 |

|

OnePlus 7, 7 Pro, 7T, and 7T Pro 5G Mclaren |

Rs. 34,391 – Rs. 45,578 |

|

OnePlus 8, 8T, 8T Plus 5G, and 8 Pro |

Rs. 38,301 – Rs. 59,390 |

|

OnePlus 9, 9R, 9 Pro, and 9RT 5G |

Rs. 43,348 – Rs. 60,290 |

|

OnePlus 10, 10 Pro, 10 Ultra, 10R, 10RT, 10T |

Rs. 35,525 – Rs. 76,398 |

|

OnePlus 11 and 11R |

Rs. 48,021 – Rs. 76,481 |

|

OnePlus 12 and 12R |

Rs. 48,021 – Rs. 76,398 |

|

OnePlus 13 & 13R |

Rs. 55,000 – Rs. 95,700 |

|

OnePlus Nord, Nord 2, Nord 2T, Nord 3, Nord 3T, Nord 4, and Nord 5 |

Rs. 23,539 – Rs. 64,073 |

|

OnePlus Nord N1, N10, N20 5G, N20 SE, N30, N40, N200, and N300 |

Rs. 16,601 – Rs. 64,073 |

|

OnePlus Nord CE 5G, Nord 2 CE 5G, CE 2 Lite, CE 3, CE 3 Lite, CE 2, CE 4, CE 4 Lite, CE 5, and CE 5 Lite |

Rs. 25,558 – Rs. 56,678 |

|

OnePlus N10 and N100 |

Rs. 10,923 – Rs. 30,114 |

|

OnePlus ACE, Pro, and Racing |

Rs. 23,666 – Rs. 58,157 |

|

OnePlus ACE 2, 2V, and 2 Pro |

Rs. 39,640 – Rs. 59,143 |

|

OnePlus ACE 3, 3V, and 3 Pro |

Rs. 39,640 – Rs. 72,750 |

|

OnePlus Open |

Rs. 110,340 – Rs. 119,747 |

PTA Mobile Tax List on Samsung:

Planning to use your Samsung phone in Pakistan? Some Samsung models require a PTA tax for network access. It is required to clear a PTA tax for the network access in Pakistan, which is applied to a few Samsung models. Below, you’ll find the latest PTA tax details for Samsung models.

|

Samsung model |

PTA Tax (CNIC registration) |

PTA Tax (Passport registration) |

|

samsung a71 pta tax |

Rs. 7865 |

Rs. 6180 |

|

samsung note 8 pta tax |

Rs. 54,392 |

Rs. 45,708 |

|

s10e pta tax |

Rs. 36,242 |

Rs. 30,456 |

|

s23 ultra pta tax |

Rs. 164,065 |

Rs. 137,650 |

|

s24 ultra pta tax |

Rs. 186,450 |

Rs. 158,000 |

|

Samsung Galaxy S25 |

Rs. 120,899 |

Rs. 99,499 |

|

Samsung Galaxy S25+ |

Rs. 118,500 |

Rs. 96,999 |

|

Samsung Galaxy S25 Ultra |

Rs. 188,450 |

Rs. 159,500 |

PTA Mobile Tax List on Nokia:

|

Price in PKR |

Price in US Dollars |

PTA Tax (CNIC registration) |

PTA Tax (Passport registration) |

|

|

nokia 105 pta tax |

Rs 4,999 |

$ 17 |

Rs. 410 |

Rs. 300 |

How to Calculate PTA Mobile Tax Online?

You can calculate your PTA mobile tax using a WeBoc web portal. Simply enter your IMEI to see all the tax amounts and other essential registration information.

Step 1: Visit the WeBoc web portal.

Step 2: then enter your mobile phone IMEI number in the required box.

Step 3: Your total duty/tax will be displayed in the following manner:

- Tax amount

- GSMA TAC

- Brand as per GSMA

- Product Description

- Marketing Name as per GSMA

- Manufacturer as per GSMA

- Model as per GSMA

How to register a mobile phone in Pakistan - PTA Registration Check:

After the confirmation of the registration status of your mobile phone, you can check for the calculated tax mentioned in the table, or you can manually calculate the PTA tax using the official web portal, the PTA calculator, or the PTA tax calculating formula.

Before jumping on to registering your mobile phone in Pakistan, make sure you have two things in hand:

- Your Device’s IMEI

- Your NADRA CNIC or passport number

How to Register a Mobile in Pakistan?

The PTA has provided every user with the simplest procedure to register their mobile device with the PTA. Here’s how you can easily register your device with the PTA.

Step 1: Go to your device’s dialer app.

Step 2: Dial the code *8484#.

Step 3: Then select the desired language from the given options.

- English

- Roman Urdu

Step 4: A menu section will appear showing 4 different options.

- Register mobile device

- Track registration status

- Delete Registration Request

- Mobile Device Count Registered with your CNIC

Step 5: Press 1 to select “Register Mobile Device.”

Step 6: Then select your region from the options:

- Pakistan

- AJK

- Gilgit Baltistan

- Back

Step 7: If you are a resident of Pakistan, then press 1, but if you are a foreigner, then press 2.

Step 8: Two options will appear on the screen.

- Mobile registration for international travelers.

- Mobile registration for local.

Step 9: Select option 1 if you want to register your device on your passport, and select 2 if you want to register your device on CNIC.

Step 10: Now, enter your passport or CNIC number.

Step 11: Enter the SIM type of your phone. Select from the options:

- Single IMEI

- Double IMEI

- Triple IMEI

Step 12: Enter an IMEI number as per your selection.

Step 13: Lastly, press 1 for confirmation.

Step 14: You will receive a pop-up message on your device’s screen to wait for the confirmation message, including information about the tracking ID, tax amount, and PSID.

Receiving of PSID:

Once the confirmation process is completed, you will be provided with a PSID, which is one essential document. The PSID number is delivered on your mobile phone in numbers.

Read on to learn about PSID and how to use this crucial document to pay the PTA tax payment.

What is the PSID number?

PSID stands for Payment Slip Identifier. This slip ID refers to the number that is linked with the tax you are about to pay against your NTN or CNIC number.

The unique numbers of PSIDs are generated through the web portal. Hence, make sure to generate the PSID number from the FBR web portal to pay the amount of PTA tax payment. PSID is used to pay taxes or dues to the government of Pakistan.

How to Pay the PTA Tax Payment?

Once you have the unique number of PSID in hand, it’s time to clear the payment, which you can do by visiting the bank along with the cash or cheque or by using a mobile application.

Step 1: Open the mobile banking application on your device.

Step 2: Go to the tax payment option.

Step 3: Click on the FBR option.

Step 4: Then type the number of your PSID.

Step 5: Lastly, click on the “pay” option.

Once the PTA tax payment is cleared, your IMEI will be registered with the PTA.

Understanding PTA Tax:

PTA tax on mobile phones was brought down in 2019 by considering some factors, including monitoring unregistered mobile phones, increasing tax revenues, reducing clone devices, and increasing tax revenues. Before 2019, it was common to bring down a mobile phone into Pakistan without paying any tax to the government of Pakistan, which caused a significant gap in the tax collection system of Pakistan.

To control clone devices and monitor unregistered mobile phones, the Pakistan Telecommunication Authority introduced a PTA tax, which each user has to pay on the purchase of their new mobile phone and when bringing a new mobile phone into Pakistan.

Why is it Important to Check for Mobile Tax?

When a user brings an unregistered smartphone to Pakistan, the smartphone gets blocked after 60 days (2 months) by the Pakistan Telecommunication Authority (PTA). You can avoid this by registering your smartphone, but first, you have to be knowledgeable of whether your device is registered or not. Check the given points:

- Monitoring of all registered devices in the country.

- PTA mobile tax helps in increasing government revenue for public services.

- Tracking of devices boosts national security.

- Legal imports reduce phone smuggling.

- Limitation of clone devices in the country.

Benefits of PTA-Registered Devices & Checking PTA Tax:

Switching to the digital PTA Tax system over traditional methods comes with several advantages. Here’s why you should opt for this streamlined process:

- Convenience at Your Fingertips

The online portal allows you to check the PTA Mobile Tax, calculate applicable fees, and make payments without visiting physical offices.

- Real-Time Updates

With quick IMEI checks and tax calculators, the platform provides instant results on your device’s compliance requirements.

- Fairer Import Practices

By ensuring mobile devices are registered, the PTA contributes to reducing counterfeit imports and encourages lawful trading practices.

- Improved Network Reliability

Phones registered through PTA work seamlessly with local telecom networks, offering uninterrupted services for calls, texts, and data usage.

- Transparency for Users

The transparent structure of the system ensures customers are never overcharged, as tax amounts are calculated based on official rates.

PEOPLE ALSO CHECK ABOUT

Tips for Maximizing Your Tax Refund with PTA Tax

Did you know there are a few simple ways to ensure you’re paying the correct tax or even getting refunds if applicable? Here’s how you can maximize your savings while staying compliant with PTA tax regulations:

- Only Declare Non-Registered Devices

Many people mistakenly pay unnecessary taxes for PTA-registered phones. Double-check your phone’s compliance status before submitting tax payments.

- Use the PTA Tax Calculator

Avoid miscalculations by relying on the official PTA Mobile Tax Calculator. This ensures you’re paying only what’s necessary without hidden fees.

- Leverage Traveler Discounts

Travelers arriving in Pakistan have an exemption on one mobile phone per year. If applicable, use this benefit before registering additional devices.

- Stay Updated on Tax Policies

PTA occasionally revises its mobile tax list and fee structures. Check the most recent updates on the PTA website to stay ahead.

- Keep Transaction Records

Always save payment receipts and SMS confirmations provided by PTA to dispute errors if needed.

Frequently Asked Questions

What happens if I don’t pay the PTA tax on my mobile?

PTA will block your mobile phone after 60 days if you don’t register it and deny it to use your local networks.

Is it secure to pay the PTA tax online?

Yes, PTA tax payments can also be made online using mobile banking apps with the Payment Slip Identifier (PSID).

Is PTA tax applicable for new and used phones?

Absolutely PTA tax is applied on used as well as new mobile phones imported from abroad to Pakistan. Registered and cleared with PTA, all imported devices, whether brand new from the manufacturer’s store or the used store, must only be usable with devices on the local network.

How can I check PTA tax on my mobile phone?

You can check the PTA tax on your mobile phone by visiting the DIRBS PTA website. Enter your IMEI number and check PTA tax on your mobile phone today.

Can I use a non-compliant phone in Pakistan without paying tax?

No. Unauthorized devices will eventually be blocked by local networks, disrupting all connectivity.

How long does it take for PTA registration after payment?

Registration is typically instant but can take up to 24-48 hours in some cases.

How can I check my PTA mobile registration status online?

You can check your mobile registration status by sending your IMEI number via SMS to 8484 or visiting the DIRBS PTA website and entering the IMEI for verification.

Is it possible to avoid paying PTA Tax?

Unless exempted due to travel policies, paying the PTA Mobile Tax is mandatory for all imported devices.

Conclusion

The regulation of PTA mobile tax is important for the mobile users in Pakistan, and more importantly, those importing devices from abroad must register their device to use its features. Any device’s user can check or calculate the PTA tax amount with the mentioned guide above. Additionally, if, after checking, you find that your device is not registered, then you can register it today with this guidance.

HOW MUCH GOOGLE PIXEL 4XL PTA TAX?