Are you paying more money in taxes than necessary? Most people in Pakistan miss out on tax-saving benefits simply because they don’t know how to check FBR active status.

Imagine having more in your pocket by checking your FBR status check online. Knowing where you stand in the FBR active filer list could make all the difference in your finances. So, read a step-by-step guide to check your FBR Status Check Online by web or FBR status check by SMS approach.

FBR Status Check - Tax Filer and non-Tax Filer

In Pakistan, the gap between those who file taxes (known as tax filers) and those who do not (known as non-tax filers) might have a significant effect on your financial situation.

A person who has filed their taxes and been approved by the government as an active taxpayer is known as a tax filer. However, an individual who does not file taxes has not submitted their returns and may be subject to penalties and higher taxes on different transactions.

PEOPLE ALSO CHECK ABOUT

FBR Status Check - Check Active Taxpayer Status Online:

With the indication of its name, Active taxpayer statusonline shows the status, which signifies that you have timely filed your tax returns and are current with your tax payments.

With this, you get lower taxes on things like bank transactions, car registrations, and real estate purchases if you are an active taxpayer. Hence, it is very crucial to have your name on the list because it is an easy method to keep extra money/savings in your pocket.

What Benefits Can You Receive by Checking Active Taxpayer Status Online?

If you wonder what benefits you would receive from being on the active taxpayer list, then here’s the list of perks that you would receive.

- Lower Tax Rates: You will be enjoying reduced tax rates for certain transactions.

- Tax Refunds: Tax refunds on overpaid taxes are eligible.

- Avoid Higher Withholding Taxes: On the Functions of Preventing Higher Withholding Tax Rates on Income and Transactions.

- Access to Financial Benefits: healthier access to loans and financial services.

- Enhanced Business Reputation: Increases the credibility and trust of business owners.

Things to Consider Before Checking your FBR Filer Status Online:

Here are some things to consider before jumping on to check your FBR filer status online using any given method.

- Accurate Identity Information: Make sure you have your NTN or CNIC on hand. Make sure you enter the data correctly because even a tiny mistake can produce inaccurate results.

- Assure Connectivity: If using the online technique, make sure there is a steady internet connection or consistent network coverage for SMS messaging.

- Prevent Errors: Verify your information again before submitting to cut down on delays or inaccurate information being sent.

- Be Aware of Response Times: Depending on the state of the network, SMS replies may take several minutes to appear, but online results will appear instantly.

- Data protection: To safeguard your personal information, be sure you are utilizing authorized channels.

- Stay Informed: Remain abreast of any modifications to tax laws or the taxpayer verification system.

Check FBR Filer Status Check Online - Complete Methods:

To find out if you are on the list of FBR active taxpayers, use the FBR filer status online methods of FBR status check or check FBR filler status by SMS.

Each method has provided a step-by-step guide to follow; read on to find the suitable method to obtain the desired information.

Method 1: FBR Filer Status Check Online:

The easiest and most efficient approach to checking your FBR Filer Status is by FBR Filer Status check online, by visiting the web portal of the Federal Board of Revenue, where you will find a whole access dedicated to checking your FBR filer status.

This method not only saves one’s time but also an effort to search for an easy and simple way of checking their FBR filer status.

Step 1: Visit the web portal of FBR.

Step 2: Navigate to the ATL status check.

Step 3: Select the NTN or CNIC number.

Step 4: Enter your NTN or CNIC number in the required box.

Step 5: In the right box, enter the image characters.

Step 6: Lastly, click on the search icon given on the right side of the page.

Step 7: The results will be showcased on your device screen.

Important Note: Internet or Network connectivity is required to check for FBR status using this method.

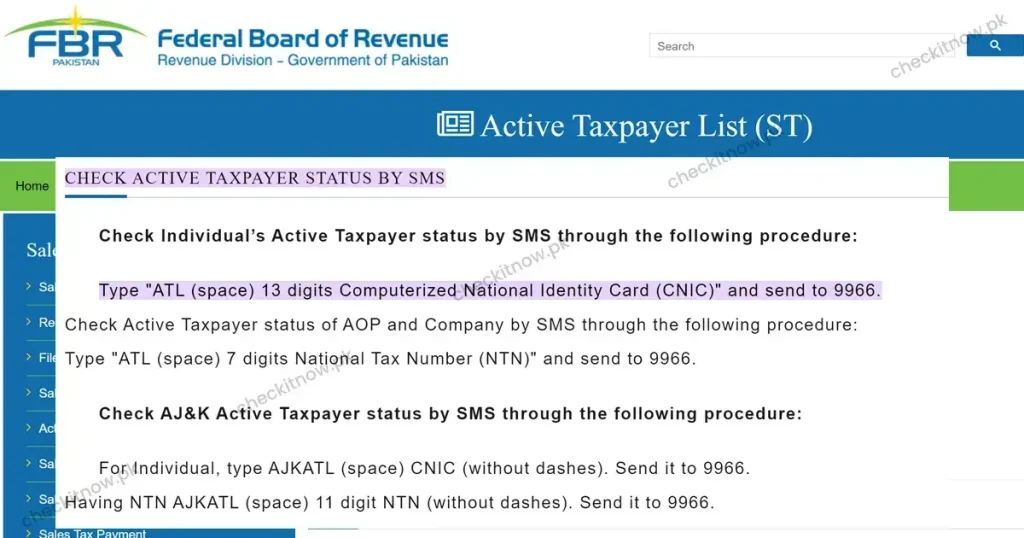

Method 2: FBR Status Check by SMS:

Facing an internet or network issue? Check the FBR filter status by sending an SMS. The step-by-step guide is listed below; follow the given procedure to find results.

● For individuals:

Step 1: Open the messaging app.

Step 2: Click on composing a new message.

Step 3: In the message, type ALT-space-CNIC.

For example: ALT 07396-3739373-7

Step 4: Send this message to 9966.

Step 5: Wait for a minute; you will receive your desired information in a minute.

● For companies:

Step 1: Click on the messaging app to open it.

Step 2: start composing a new message.

Step 3: In the message, type ALT-space-NTN.

For example: ALT 3736498

Step 4: Send it to 9966.

Step 5: Wait for a few minutes; your desired information will be displayed on the screen.

How To Check FBR Filer Status for AJ&K Active Taxpayer:

Don’t worry if you are a resident of Azad Jammu & Kashmir, as you can check the FBR filer status using the detailed step-by-step guide which is given below.

● For individuals:

Step 1: Start composing a new message in the messaging app.

Step 2: Now type AJKATL-space-CNIC.

Or

Type an AJKATL (space) 11-digit NTN number.

Step 3: Lastly, send it to 9966.

Important Note: CNIC and NTN numbers shouldn’t have any space in the numbers.

Method 3: FBR Filer Status Check Online using FBR App:

Another specialized method to check FBR filer status is by utilization of the FBR app. Follow the assisted guidelines to obtain results on the filler status.

Step 1: Download the Tax Assan app on your smartphone.

Step 2: Once downloaded, install the app.

Step 3: Click on the app to activate it.

Step 4: Navigate to the active taxpayer list section.

Step 5: Enter your CNIC, NTN, or passport number to check your filler status.

Step 6: Select the date.

Step 7: Lastly, click on the “verify” button for the results.

PEOPLE ALSO CHECK ABOUT

How to Download the Active Taxpayer List (income tax or sales tax):

Many people wish to check the active taxpayer list, so if you are one of them, then follow the given steps:

Step 1: Visit the FBR website.

Step 2: Scroll down on the page.

Step 3: You will find the section “online verification” there.

Step 4: Now click on the Active taxpayer list from the options given on the left side.

Step 5: Scroll down and find an active taxpayer list form.

Step 6: Enter the required information, which includes:

- Parameter type

- Registration number

- Date

- and enter the CAPTCHA number in the required box.

Step 7: Lastly, press the ‘Verify’ button.

Note: proofread the information before pressing the verification number.

How to Download Active Taxpayer List (income or sales tax) for AJ & K:

Step 1: Visit the web portal of FBR.

Step 2: On the shown page, scroll down.

Step 3: Find the section “online verification” on the page.

Step 4: Then click on the Active Taxpayer list (AJK) from the given options.

Step 5: Scroll down and find an active taxpayer list form.

Step 6: Enter the information in the required areas, including:

- Parameter type

- Registration number

- Date

- and enter the CAPTCHA number in the required box.

Step 7: On last, press the ‘Verify’ button.

Frequently Asked Questions

Why should I verify that I am a current taxpayer?

Verifying your current tax status will help you make sure you are paying less in taxes on things like bank transfers, property purchases, and car registrations. It validates that you are in compliance with tax laws and helps you save money.

How frequently should I verify my status as a taxpayer?

To make sure you are still included on the Active Taxpayer List (ATL), it is essential to verify your status once a year, particularly after completing your tax returns.

Is it possible to use a smartphone to monitor my status?

Yes, you can quickly and conveniently use SMS to check your status as an active taxpayer by submitting your NTN or CNIC number to 9966.

Is internet access required to verify my taxpayer status?

You can use SMS to confirm your status without requiring an internet connection, even though checking online does.

After checking my status, how long does it take to receive a response?

The answer for checks made online is immediate. Depending on network conditions, it can take a few minutes for SMS queries.

Conclusion

Maintaining an accurate record of your current tax situation is essential to effective money management. You can take advantage of financial benefits like lower tax rates in addition to maintaining compliance with tax regulations by routinely monitoring your status. Checking your status is quick, straightforward, and necessary for wise money management, whether you use internet resources or basic SMS services.